Salary Sacrifice and Your Business Cost-Savings Strategy

5 November 2024

The Autumn Budget and recent changes to the Employee Rights Bill 2024 reflect the changing landscape, putting more power in the hands of the employee. Many UK employers are concerned by the announcement of the minimum wage and NIC increases. It’s more critical than ever to explore ways to make employer savings. During this blog, we’ll explain why salary sacrifice schemes should be at the heart of your post-budget savings strategy.

What is Salary Sacrifice?

We answer this question in depth in our blog - What is Salary Sacrifice? It's a must-read for a complete overview of the barebones and fundamentals of salary sacrifice schemes. While we advocate employee wellbeing, we’re also the smart partner in employers’ corners, helping them discover new ways to create opportunities and thrive. Unlike other blogs, this one focuses on how employers can alleviate the burden of NIC and wage increases.

Your Post-Budget Savings Strategy

The Autumn Budget promised growth, investment, new skills, and to get those able back to work. Employment Allowance increases, the corporation tax cap, and business rate relief for those in the retail, leisure and hospitality industries will alleviate the impact of some of the planned increases. Still, since the announcement, businesses have expressed concern over the salary and NIC changes.

The Wage Increase Double-Whammy

The legal minimum wage for employees over 21 will rise to £12.21 an hour - a 6.7% increase. Employees aged 18 - 20 will see their wages increase to £10 per hour - up 16.3%.

The story doesn’t end there for employers.

Employer NIC contributions will increase to 15% from April 2025. The rise in the minimum wage already ups the employer's NIC contribution, so the two combined impact a business’s payroll bill twice.

The new laws surrounding zero-hours contracts impact the industries that employ the most people on National Minimum Wage - retail, hospitality, leisure - so many businesses will feel the financial impact of these changes.

In a world where living costs remain high, steps to protect and increase employee wages are welcome. Still, where would we be without the businesses providing the work?

Your Business Cost-Savings Strategy

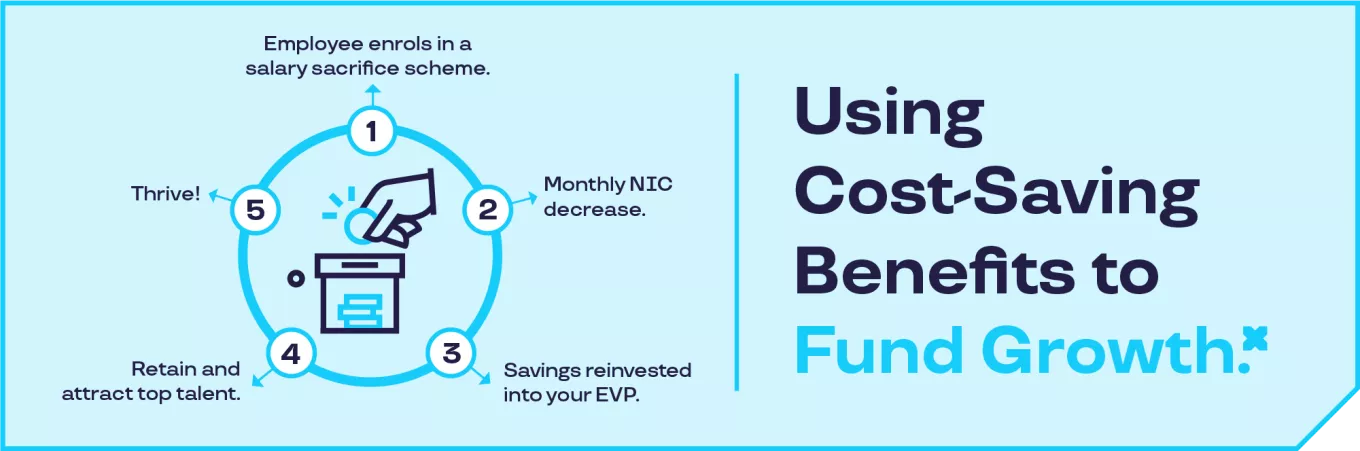

Change is upon us, and we must embrace the positives to thrive. As we expressed in our LinkedIn article responding to the Autumn Budget, employees can perform better when they feel more secure in their financial and working situations. There’s an opportunity to nurture this enhanced state of employee wellbeing to create a loyal, engaged and highly productive workforce, creating a world of opportunities for your business.

Attracting and retaining the best people is vital for business growth, so remaining competitive as an employer is essential. Thankfully, there are employee benefits available that enhance your Employee Value Proposition (EVP) and save your business money.

Salary Sacrifice Schemes

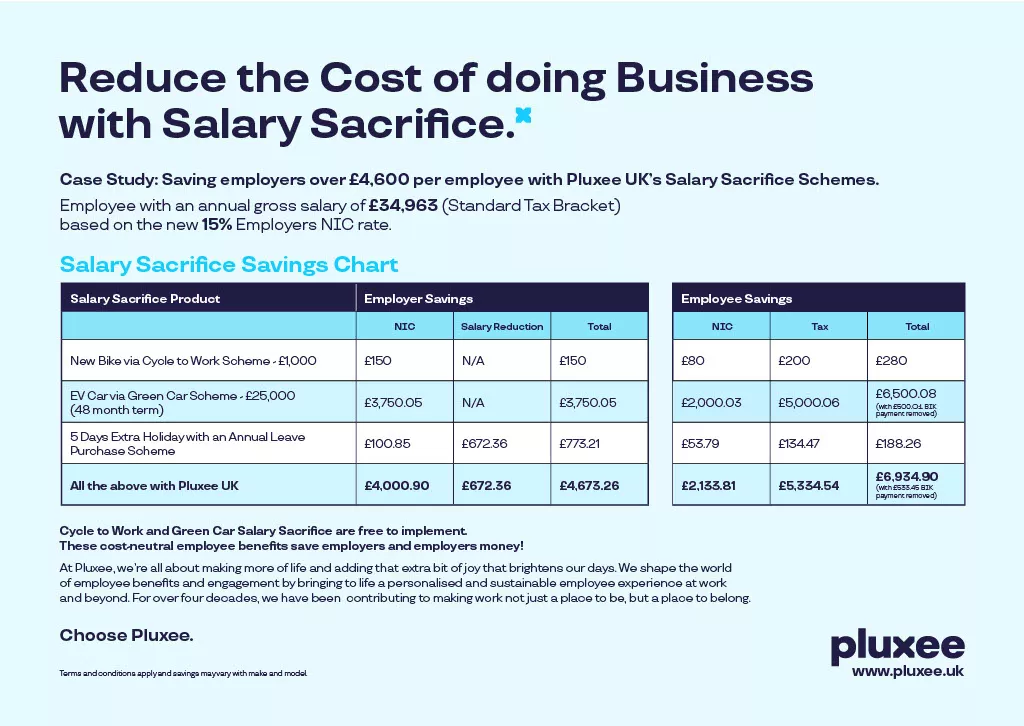

Salary sacrifice schemes aren’t new. The Cycle to Work scheme began in 1999, with the Electric Car Salary Sacrifice Schemes following in more recent years. Both schemes reduce the NIC employers must pay for employees using the schemes. From April 2025, the Employer NIC contribution will increase to 15%, and we’ve created a Salary Sacrifice Savings chart to illustrate how much money a business could save per employee by encouraging them to enrol in your salary sacrifice schemes.

Cycle to Work Schemes

The approval process for Cycle to Work salary sacrifice schemes has evolved with the changes to hybrid and remote working. The essential thing for an employer to remember is that a cycle-to-work scheme is free to implement, and we can bolt it onto our Employee Discounts Platform at *no extra cost.

Using our example savings above, an employer could save £150 for every employee taking on a Cycle to Work salary sacrifice scheme for one year. The maths is simple – the more employees who enrol, the more money your business can save. Twenty employees = £3,000 savings, 30 = £4,500 savings... and so on.

You’re giving your employees access to an employee benefit that enhances their physical health, reduces their carbon footprint and cuts the cost of their commute, improving their financial wellbeing. Plus, with no up-front business cost and saving you money, too.

EV Car Schemes

Electric Car Schemes deliver even bigger savings to the employer!

As you can see from the example above, our Green Car scheme can save employers over £3,700 in National Insurance Contributions. Different variables determine the savings, but with bespoke quotations available, you can calculate each case individually. As a larger ticket item, the salary sacrifice repayment period spans a longer term than a single bike, but the employer NIC savings are considerably more significant. Using our example estimate above, just 30 employees on a car scheme would save your business over £110,000!

We’re using examples and estimated figures. While we can’t be exact on the numbers at this stage, what matters is the opportunities a Green Car and Cycle to Work salary sacrifice scheme deliver to your business. With salary sacrifice, there’s no need to make cuts; you can deliver employee benefits that enhance your EVP, support your CSR ambitions, boost employee wellbeing, and retain top talent.

Annual Leave Purchase Schemes

As you can see from our example savings chart, employers benefit from NIC and salary reduction savings when an employee purchases extra holiday allowance via their Annual Leave Purchase Scheme. Just five days of purchased holiday can save employers over £700!

Some consider it a controversial offering, given that employees earn less due to paying and taking this extra time off. As we reveal in our podcast - Your Employee Mental Health Toolkit - many employees value time with their family above any other employee benefit you can offer. If they feel they can afford it, they will gladly purchase extra leave, enhancing their work-life balance.

Salary Sacrifice Pensions

HR Review shared post-budget insights on salary sacrifice pensions, suggesting that potential changes to NIC charges on pensions did not form part of the budget.

Any businesses that are still procrastinating on implementing a pension salary sacrifice arrangement should look to put them in place as soon as possible to benefit from the increased NIC savings.

The Growing Importance of Employee Benefits

With employer wage bills set to increase, so does the importance of embedding budget-maximising, salary-stretching employee benefits. We understand from conversations with our clients that when the lower wages increase, more senior employees often expect theirs to rise, too. This is especially true when the minimum wage increase closes the gap between pay bands.

Offering employees a competitive salary matters in a landscape where there’s a battle to retain and attract the best skills and talent.

Salary isn’t the only thing that matters. Employers want to work for companies that align with their values, have a positive workplace culture, and provide employee benefits that can give such value that they can be worth more than a pay raise. Employee Discounts make everyday living more affordable, offering up to 20% off with over 100 retailers. Our cashback-earning Pluxee Card allows employees to earn up to 25% cashback with over 80 retailers, helping employees build a pot of funds they can use towards reducing other costs.

Mental health in the UK is in decline, and it’s starting at an earlier age. An Employee Assistance Programme supports employee wellbeing by providing employees with online resources and access to Information Specialists and BACP-accredits counsellors 24/7, 365 days a year.

When you combine EVP-boosting employee benefits with those that save employers money, you’re putting your business in the best position to remain competitive without hurting your bottom line.

The Non-Financial Perks

It’s not all about the savings... Whilst saving money for the business and employees is a big selling point, it’s not the only benefit of a salary sacrifice scheme.

By helping an employee stretch the cost of a new bike they'll use for their daily commute, you’re also helping them to get fit. A cycle to work scheme is a financial and physical wellbeing benefit, making exercise affordable.

Let’s not forget that physical and financial wellbeing impact our mental health. By getting your people on their bikes, you’re also boosting their mental wellbeing. When your employees feel physically, mentally, and financially healthy, they will be more engaged in the workplace, boosting productivity. Plus, a healthier and happier workforce will have fewer absences, reducing the cost to the business and the economy.

When your employees feel supported by their workplace and engage with the benefits on offer, you’re more likely to keep them. The recruitment process is costly, and retaining employees is essential.

Build Your Business Cost-Savings Strategy with Salary Sacrifice and Pluxee UK

For over four decades, we’ve been contributing to making work not just a place to be but a place to belong. When employees feel loyalty towards your business, they’re more likely to remain with you and be more engaged, motivated, and productive, helping your business thrive. Offering employees an attractive EVP that enhances their financial, mental, and physical wellbeing helps to solidify their loyalty, and when benefits can save employers money, they deliver an even more significant advantage to your business.

Discover how employee benefits and salary sacrifice schemes can form an essential part of your cost-savings strategy.