What is cashback? Employee cashback cards & cashback online

What is cashback? What’s the difference between cashback cards and earning cashback through online deals? More importantly, what role does cashback play in the employee benefits space? In this blog, we’ll address all your questions about cashback, exploring the versatility of an employee cashback card.

Content:

How does cashback work in the UK?

What is cashback online, and how does it differ from a cashback card?

What is the cashback promotion process?

Are cashback payments taxable?

How does cashback work as an employee benefit?

Employee cashback cards: benefits to employees

In a rush? Here are some key takeaways...

- Cashback is a powerful, non-taxable financial perk: Cashback enables employees to earn a percentage of their spending back, whether through online deals or a prepaid employee cashback card. Crucially, the cashback itself is not taxable, making it a cost-effective way to boost take-home value without triggering tax complications.

- Cashback cards offer flexibility and control: Unlike credit-based reward schemes, an employee cashback card is prepaid, helping your workforce avoid debt while budgeting more effectively. Use the cashback card for essential spending or high-ticket items and take advantage of the added benefits of partner cards for household-wide savings.

- Cashback supports financial wellbeing and stretches salaries: By earning money back on everyday purchases, employees can stretch their salaries, manage expenses more effectively, and develop better financial habits, which is essential during a cost-of-living crisis.

- Employers benefit from streamlined incentives and rewards: Businesses can utilise the cashback card for various initiatives, including employee rewards, cost-of-living contributions, channel incentives, or even membership perks—all from a single platform. This streamlined approach reduces admin overheads while increasing the value of every penny spent.

- Cashback enhances EVP, engagement, and retention: A cashback card can boost morale, loyalty, and retention by demonstrating support for employee wellbeing. It's a strong differentiator in your Employee Value Proposition (EVP) and helps attract top talent in a competitive hiring market, without inflating payroll costs.

If you've got time to stick around, let's dive a little deeper.

What is cashback?

Cashback is when a retailer gives you a percentage of money or a fixed sum of cash in return for purchasing their goods.

Often used to tempt consumers into buying high-end goods, many retailers offer a percentage or fixed cashback amount when you spend with them. An employee cashback card applies the same concept but uses it differently, allowing employees to earn cashback on everyday essential spending as well as special treats and more expensive items.

How does cashback work in the UK?

So, how does cashback work? In a nutshell, you purchase an item from a retailer, and they return a percentage of the value of the sale as cashback.

It’s a simple transaction. You or your employees purchase an item or service via a specific UK retailer and earn cashback. That’s cash that gets returned to them to spend as they wish.

If buying directly from a retailer, they’ll pay the cashback to the same payment mechanism used to make the purchase. When employees use an employee cashback card, they’ll return the money to that card, allowing them to accumulate a pot of cashback.

Cashback deals, whether online or via a card, don’t reduce the price at the point of sale. There’s no money off as a discount or saving. Instead, they earn the cashback based on what they spend, and the retailer sends it to them.

What is cashback online, and how does it differ from a cashback card?

With a cashback online deal, your employees would log in to their benefits platform, click on a specific cashback deal, and make the purchase. The retailer then processes the transaction and the cashback claim.

How does online cashback work?

If you’re providing your employees access to online cashback deals, they’ll access them via their employee benefits platform. The link they use will allow the retailer to track the purchase, calculate the amount of cashback the transaction will earn them, and return it to their online account or bank account.

How do you earn cashback online?

It’s easy! Browse your employee benefits platform to ensure you know which retailers you can earn cashback with and do your shopping via the retailer links provided.

What is a cashback card?

There are many types of cashback cards available. Banks offer cashback and rewards with some credit cards, with users earning cashback from purchases made with their credit cards.

An employee cashback card through Pluxee UK is different. It’s a prepaid card, so there’s no credit, interest or debt. Employees load funds onto their cards, spend them with a retailer participating in our cashback scheme, and earn cashback from the transaction.

Much like with online cashback, the retailer pays the employee a percentage of the sale amount. Instead of going to the employee’s bank account, the retailer sends cashback to the employee's cashback card, where they can watch their cashback accumulate.

Our employee cashback card is powered by the Visa prepaid network, allowing your employees to spend their funds virtually anywhere.

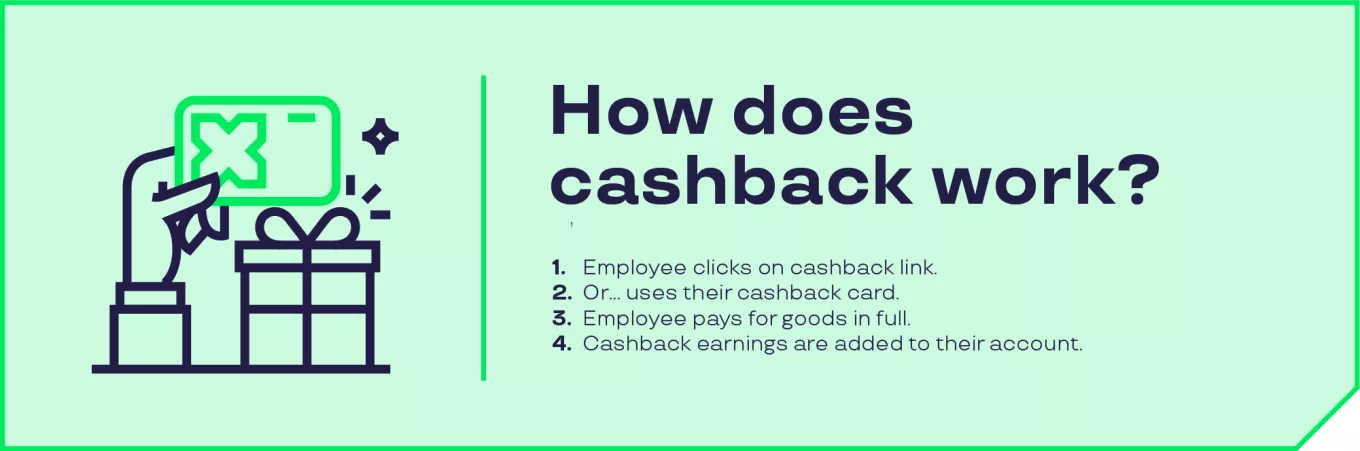

What is the cashback promotion process?

We partner with over 80 retailers, offering a variety of cashback deals ranging from 4 to 15%. Cashback deals can change throughout the year, with special, limited-time offers where employees can earn even more cashback.

When you embed our employee cashback card into your benefits package, you’re giving your employees access to over 80 retailers. Our cashback card app shows every retailer we partner with alongside their cashback deal. They can also see any special offers or cashback promotions and can top up their account with extra funds on the go.

Your employees can access online cashback deals via their employee benefits platform, and our in-house marketing team will keep them updated whenever a new retailer joins our network, or we have a new cashback promotion to share.

Are cashback payments taxable?

Cashback payments aren’t taxable.

We’re discussing cashback payments in the employee benefits space, so it’s understandable that questions over the tax implications may arise. What’s important to remember is that your business could use our employee cashback card in different ways:

- An employee benefit

- An employee reward

- For channel incentive payments

- Within your membership and loyalty scheme.

Depending on whether and how an employer adds money to the card, either as part of an employee benefits initiative or as an employee reward, there could be some tax implications to consider.

However, when it comes to the cashback payments, there is no tax to consider here. The cashback relates to how an employee spends the money they’ve either been gifted by their employer or added to the card themselves. The cashback earned through spending that money isn’t taxable, regardless of how the money was loaded onto the card.

How does cashback work as an employee benefit?

Cashback allows employees to earn money when they spend, which is why it’s such a popular employee perk. Every time they use their employee cashback card with a participating retailer, they earn a percentage of the spend back, and they can use it to make life more affordable.

The perks of employee cashback cards don’t end there.

Employee cashback cards: benefits to employees

Why are employee cashback cards so beneficial to employees? They help stretch salaries, provide financial support for the household, and are an effective way to manage budgets.

Stretching salaries

The cost of living remains high, and some salary increases aren’t keeping up with inflation. An employee cashback card helps stretch salaries further. Employees can earn cashback on the items they need to buy every day, week, month… so they’re earning money back from the things they would already be buying.

The fact that they can earn cashback with such a variety of retailers means that when they do need to make more expensive purchases, cashback helps make them more affordable.

Household support

We provide the option of adding a partner card to your employee cashback card scheme, allowing for an extra card to enter your employees’ households. This means that no matter whose turn it is to do the weekly shop, your employees and their families will never miss the chance to earn cashback when they spend.

Money management

An employee cashback card also helps your workforce manage their money.

As a prepaid card, once employees load funds onto their cards, that's where it stays. They can’t withdraw cash from it. Employees can load the amount of money they need to cover their essential monthly expenses, protecting it from any bills due to leave their bank account.

Loading the money onto their employee cashback card keeps it separate, so they can always afford to cover the cost of essential items, such as the weekly food shop.

Better spending habits

Setting the money aside helps employees adopt better financial habits, but that’s just the first step. When they allocate the money to their cashback card, they’re more likely to spend it with retailers that are part of our cashback scheme.

Employees can see where they can earn cashback on the app and are more likely to adopt the behaviour of checking first before they spend, so they use every opportunity available to earn cashback and make their money work harder.

Employee cashback cards: benefits to employers

What do you get when you embed the best cashback card the UK has to offer? Why be modest...Our employee cashback card is a versatile solution that streamlines processes and stretches HR budgets further.

Streamlining multiple processes

Our employee cashback card streamlines multiple processes into one payment mechanism.

- Employee rewards: You can load employee rewards onto the card. This means you’re using the same details for each employee every time, and your rewards have a greater impact because employees can earn cashback.

- Employee benefit: If you make cost-of-living contributions or disbursements, you can load the money onto your employees’ cashback cards. They then go on to spend it with a cashback-earning retailer, making the money stretch further.

- Member benefit: Give your members more reasons to renew by including a cashback card in your membership package. Worcestershire County Cricket Club use theirs as their fans’ unique stadium pass. We've added their stadium vendors to our cashback network so that fans can earn cashback on match day, too.

- Channel incentive: If you issue incentive payments to your channel partners, then you can sweeten the deal even further by allowing them to earn cashback.

Boosting employee engagement and loyalty

Salary-stretching employee benefits that improve financial wellbeing and quality of life help to create a more engaged workforce. This engagement boost comes from employees worrying less about money, living more healthily and getting more joy from life.

When employees feel supported by their employer, they’re more likely to go the extra mile.

Increase employee retention and attraction

Your Employee Value Proposition (EVP) can help you retain and attract top talent. Offering the best salary over your competitors just got more expensive due to the increase in employer National Insurance Contributions (NIC). A comprehensive range of employee benefits, especially those that make salaries stretch further, helps you stand out as an employer of choice, retaining and attracting the best people without impacting your bottom line.

Employee cashback cards with Pluxee UK

Thank you for reading our deep dive into all things cashback. Whether you embed online deals or our versatile cashback card, you’re helping to make life more affordable and joyful for your employees.

Whether you aim to improve morale, alleviate financial stress or keep the skills your business needs to thrive for years to come, a cashback card ought to be part of your strategy.

Cost-effective yet impactful… cashback is king!

FAQs

How many retailers are there on your cashback card network?

We currently partner with over 80 retailers on our employee cashback card network and are always speaking with potential partners to grow this further.

How many deals are on your online cashback platform?

We currently partner with over 150 retailers via our employee discounts platform and online cashback deals.

Where can employees spend their cashback card funds?

Our cashback card is powered by Visa, so employees can spend their funds wherever Visa prepaid is accepted, whether the retailer is part of our cashback network or not.

Can cashback be withdrawn for cash?

No. It’s not possible to withdraw funds on the cashback card for cash at an ATM.

Are prepaid cashback cards better than bank credit cards?

That depends on your perspective. A credit card accumulates interest, and some employees may find themselves able to pay off only the minimum amount each month. It’s up to them to determine whether the cashback rewards outweigh the risk of debt. Our employee cashback card is a prepaid card, so it only allows you to spend up to the available value. There’s no credit, so there's no debt and no credit checks, making it something you can offer all employees, regardless of their credit scores.

How do I apply for online cashback deals?

Our online cashback deals are part of our Employee Discounts Platform. The business would contract with us to embed this employee benefit into their operations, and each employee would receive a unique login.

How do I apply for an employee cashback card?

Employers embed our employee cashback card, the Pluxee Card, into their business as an employee reward or benefit. Each employee then applies for their card unless the employer allocates one to each employee on their behalf.